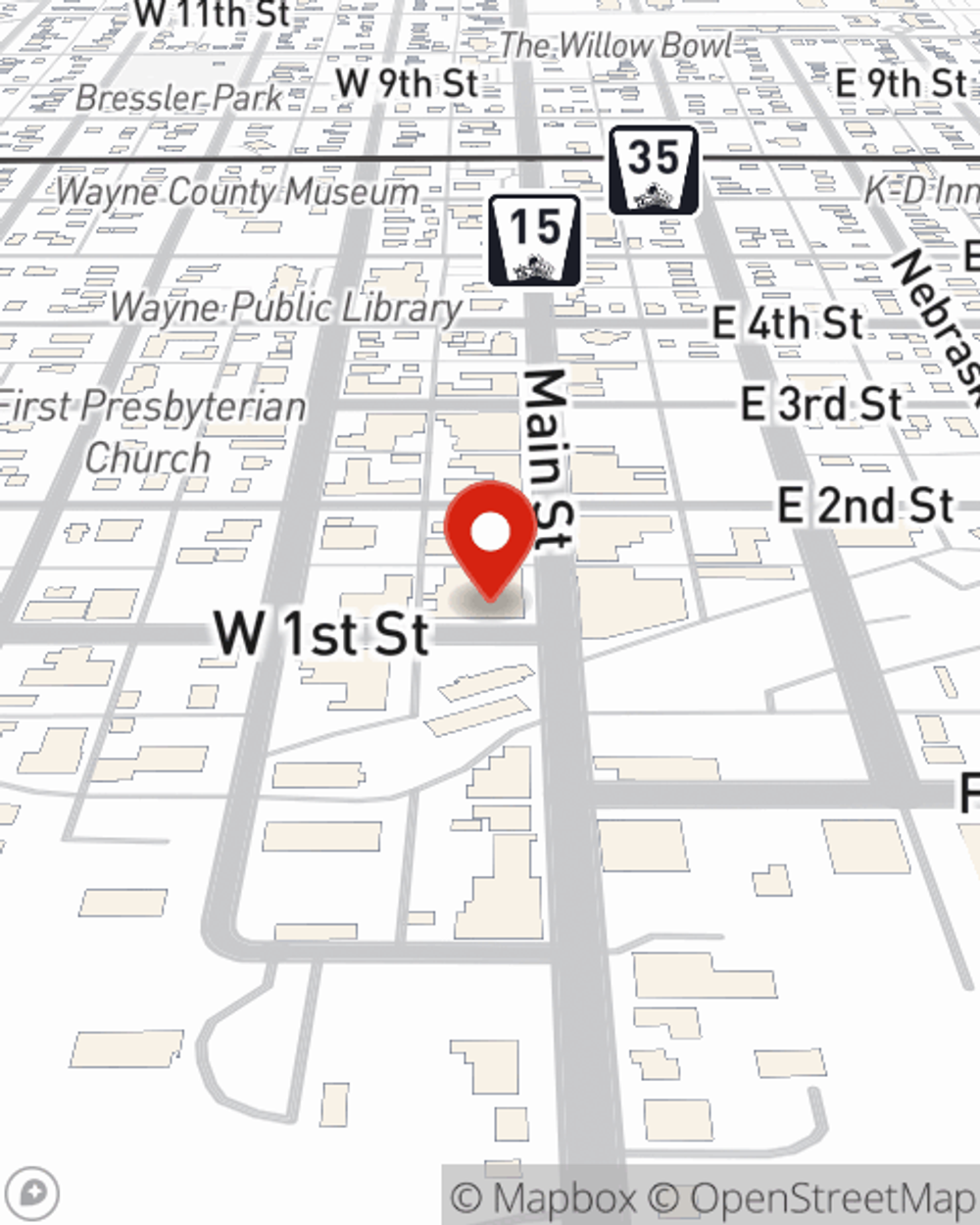

Business Insurance in and around Wayne

Searching for protection for your business? Search no further than State Farm agent Jeff Markworth!

No funny business here

- Wayne

- Wakefield

- Norfolk

- Sioux City

- Yankton

- Vermillion

- Ponca

- Denver

- Omaha

- Iowa City

- Laurel

- Rapid City

- Sioux Falls

- Lincoln

- Des Moines

- Cedar Rapids

- Pierre

- Dubuque

- South Sioux City

- Fort Dodge

- Greeley

- Sidney

- Davenport

- Brookings

Cost Effective Insurance For Your Business.

When you're a business owner, there's so much to remember. You're not alone. State Farm agent Jeff Markworth is a business owner, too. Let Jeff Markworth help you make sure that your business is properly covered. You won't regret it!

Searching for protection for your business? Search no further than State Farm agent Jeff Markworth!

No funny business here

Keep Your Business Secure

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your take-home pay, but also helps with regular payroll costs. You can also include liability, which is crucial coverage protecting your business in the event of a claim or judgment against you by a consumer.

At State Farm agent Jeff Markworth's office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Jeff Markworth

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.